Forms U S. Department of the Treasury

Content

Auxiliary aids and services are available upon request to individuals with disabilities. Kaye Morris has over four years of technical writing experience as a curriculum design specialist and is a published fiction author. She has over 20 years of real estate development experience and received her Bachelor of Science in accounting from McNeese State University along with minors in programming and English. Complete Part II of Form 8822 with your business name, employer identification number, old business address and new business address. Hearst Newspapers participates in various affiliate marketing programs, which means we may get paid commissions on editorially chosen products purchased through our links to retailer sites.

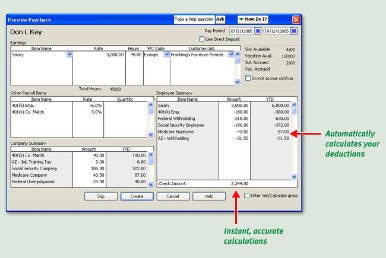

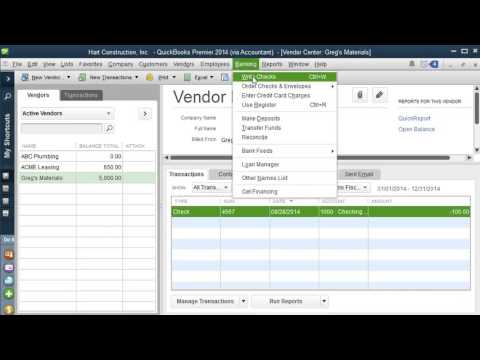

As a small Form 941 Mailing Addresses Are Changed owner or HR manager, you need to be aware of numerous tax forms and compliance regulations. These annual and quarterly reports are essential for keeping your organization compliant. Even if you have only one employee, you must comply with federal and state annual and quarterly employment tax reporting and deposit requirements. If you have successfully selected direct deposit in a past E-file tax return, you may have to edit what you pull up from last year – to change any bank or direct deposit information that was saved. However, once you have successfully filed your return, the banking information cannot be changed. The IRS needs your updated address in order to send you important correspondence or mail you a refund check. The IRS provides several options for notifying the agency of an address change.

Mailing Addresses for Forms 941

This happened first in 2020 when the Families First Coronavirus Relief Act and Coronavirus Aid, Relief, and Economic Security Act were signed into law that March. The FFCRA added paid leave for COVID-19 related reasons and an employer credit related to this paid leave. The CARES Act added the Employee Retention Credit , another employer tax credit for certain businesses affected by COVID-19, as well as other payroll-related items. Two subsequent bills, the Consolidated Appropriations Act of 2021 and the American Rescue Plan Act , amended and extended these and other provisions. The Infrastructure Investment and Jobs Act ended the ERC for most employers after September 30, 2021, instead of after December 31, 2021. These changes resulted in multiple revisions of Form 941 to add line items for reporting purposes and subsequently remove them after some provisions expired.

- You should also provide identifying information for both yourself and the person you’re representing.

- Auxiliary aids and services are available upon request to individuals with disabilities.

- The IRS needs your updated address in order to send you important correspondence or mail you a refund check.

- To notify TWC you have acquired another business; see Acquired a Business.

- The IRS is authorized to use a taxpayer’s last-known address when sending documents or other communications.

For example, the last month of the first quarter for calendar year taxpayers is March. You can request a filing extension of 30 days with the Social Security Administration by sending Form 8809, Request for Extension of Time to File Information Returns.

Employment Tax Returns Explained

You are responsible for https://intuit-payroll.org/ing any additional tax liability you may owe. A simple tax return is one that’s filed using IRS Form 1040 only, without having to attach any forms or schedules.

- These annual and quarterly reports are essential for keeping your organization compliant.

- Your expert will only sign and file your return if they believe it’s 100% correct and you are getting your best outcome possible.

- This gives you one month to prepare the form before submitting it to the IRS.

- Federal law requires employers to withhold certain taxes from the pay of employees.